BECU’s refinance figuratively speaking

BECU’s student loan refinancing options are into the level with lots of most other lenders’ refinance unit. Costs try competitive, however your exact speed depends on items together with your credit score and you can earnings. You could use with good cosigner to improve your chances of qualifying for a loan. Instead of particular lenders, with BECU, you could potentially launch the cosigner immediately following 24 months regarding into the-time and successive repayments.

The maximum amount you could potentially re-finance is dependent on the sort from money you really have. BECU simply allows refinancing having undergraduate financing up to $100,000. The utmost having graduate loans or those people moms and dads grabbed away try $125,000. The minimum refinancing count is higher than we’ve got seen with other competition.

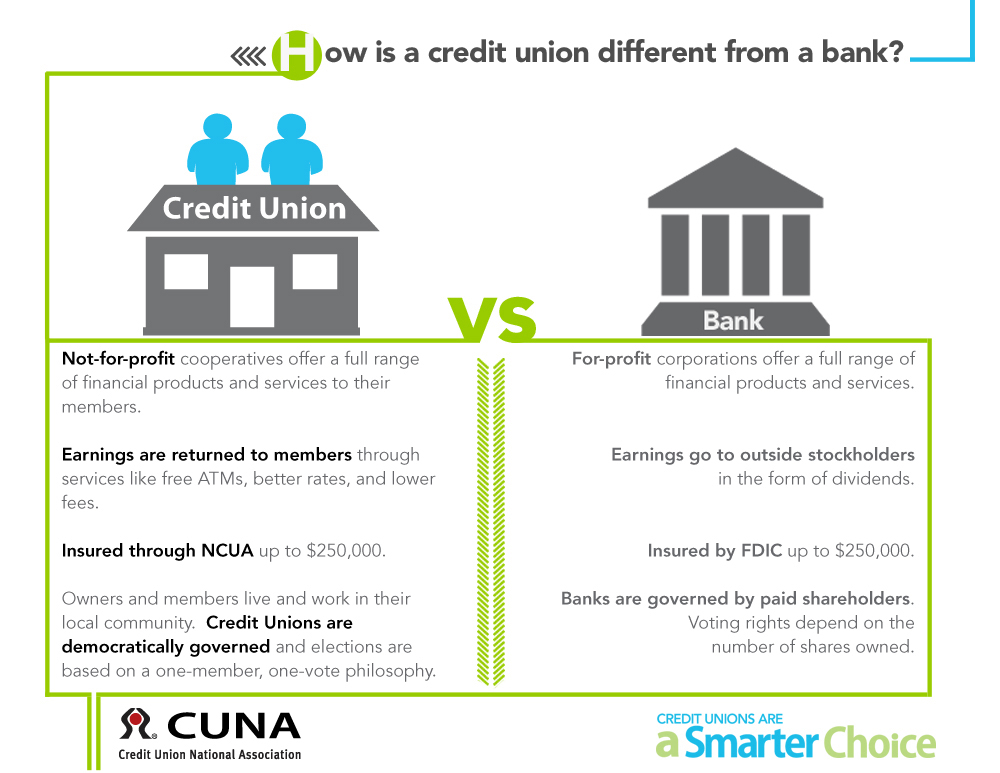

Even although you want to re-finance that have BECU, you might not manage to if you’re unable to fulfill the credit partnership registration criteria. Your mustbe a resident or college student inside the Arizona county, reside in select areas inside the Idaho or Oregon, or provides an affiliation in order to BECU couples so you can qualify for membership. Otherwise, other choices are more appropriate.

Pricing, terminology, plus

BECU’s student loan refinancing costs act like exactly what many opposition give, however your offer hinges on your own borrowing character or any other situations.

Minimal re-finance number on $10,000 exceeds many other loan providers, in addition to restrict amount is lower. In place of its private figuratively speaking, BECU’s home mortgage refinance loan now offers multiple installment term solutions however, no elegance months.

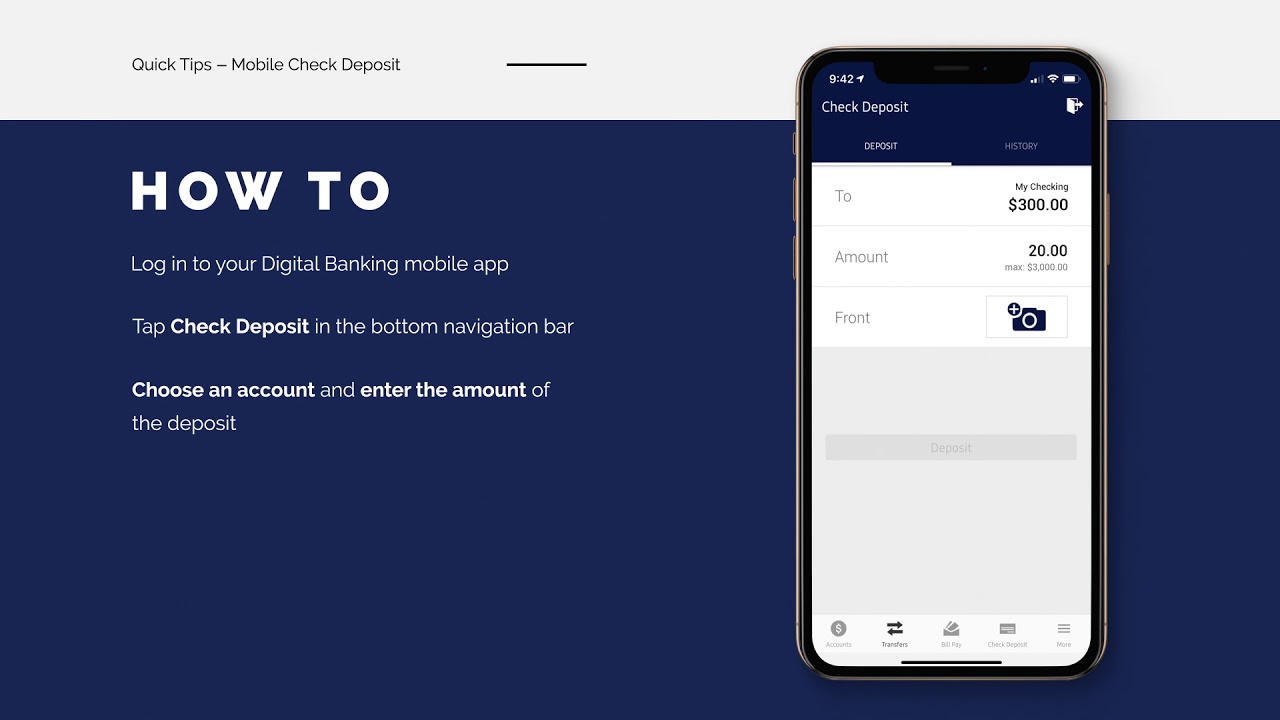

BECU’s education loan refinancing is even maintained through Lendkey. The financial institution work with you about what funds you need to help you re-finance, whether or not you to definitely otherwise multiple financing. You ought to log on to your bank account on the web owing to Lendkey in order to control your mortgage otherwise name 866-291-6868 to speak with a representative.

When refinancing, you can select from around three cost terms: five, ten, or fifteen years. BECU lets applicants in order to refinance the following brand of college loans:

- Government college loans

- Private college loans from other lenders

- Federal figuratively speaking applied for by the moms and dads (elizabeth.g., In addition to money)

Loan terminology and you will refinancing choices are with the par together with other pupil loan lenders that offer refinancing. You earn self-reliance about how soon we wish to pay away from your own money.

Such as, if you’d like to refinance to repay your loan smaller, you could potentially opt for the five-year name. The individuals wanting to down their monthly installments should continue their cost label so you’re able to fifteen years. The fresh new stretched the expression, more you can pay when you look at the notice.

Who has eligible for BECU individual and you will re-finance student loans?

Merely BECU people meet the criteria to have for the-college or university and you can refinance figuratively speaking. The lending company suggests cosigners if you feel it can raise your likelihood of bringing accepted. Borrowers need to be at the legal decades in their condition out of household and stay signed up for a qualified college or university or finished of one having refinancing.

Moms and dads who will be BECU professionals having a valid Societal Protection count also can refinance Moms and dad Along with or being qualified personal student loans. The credit relationship cannot discuss lowest borrowing or money conditions. Discuss with BECU to see anything you qualify for.

Benefits and drawbacks of BECU’s college loans and you can refinance money

Consumers can decide anywhere between one https://paydayloanalabama.com/weogufka/ or two choices for in-college or university repayments because of their student loans and can pick from about three financing conditions for the re-finance money.

Candidates normally register good cosigner on their loan application, which can increase chances of bringing approved getting a student loan, especially if the cosigner has actually sophisticated borrowing from the bank.

Only a few lenders assist consumers reduce cosigners as opposed to refinancing in order to good the mortgage. So long as you renders a couple of years off on-time consecutive repayments so you can BECU, you can consult to produce your cosigner.