To get a keen Camper? Play with our very own effortless Camper online calculator to check your monthly obligations otherwise calculate your own overall amount borrowed.

step https://www.paydayloancolorado.net/todd-creek 1. Estimate Your Commission

Whether you are a seasoned RVer or not used to new camping world, that it adored interest is present to highway fighters. If you’re to shop for a new otherwise used Camper, you are able to Trident’s Camper finance calculator knowing your capital possibilities. Enter the payment per month you really can afford discover a loan number otherwise promote your full Rv loan amount to return the projected monthly installments.

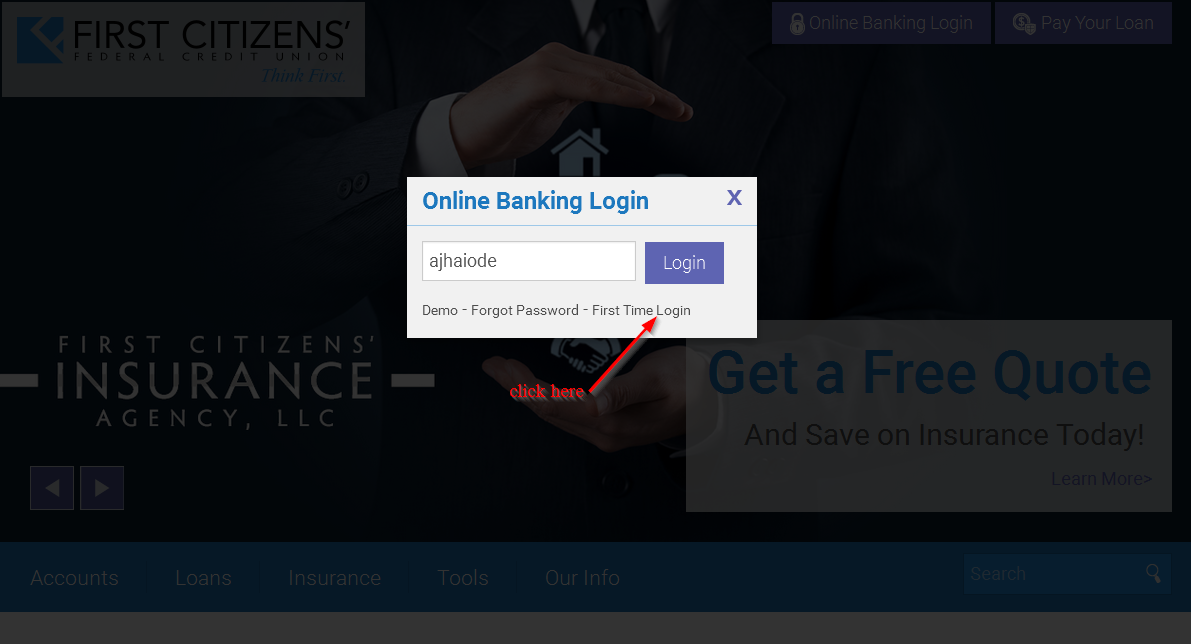

2. Make an application for financing

Now that you have a sense of your own projected Rv mortgage payment otherwise full loan amount, you might complete your loan app. It takes merely a few minutes! We’ll ask you to let us know concerning sort of Rv, rv, otherwise motorhome you happen to be to order and a few information regarding debt condition so we can suits one to the fresh new relaxation lender that is good for you.

3. Log on to the street!

After you fill in your own Camper loan application, the devoted party out of mortgage officers reaches work! I normally have an answer regarding a leisurely bank from inside the 24-48 hours. Whenever we you want more documentation, we shall extend. All you have to create are dream of as a course warrior. We shall support you in finding the interest rate and you will Camper mortgage financial that suit your financial allowance and you can existence.

Frequently asked questions

You can expect multiple terms ranging from 6 so you’re able to 20 many years according to the Rv loan amount. Generally, Rv fund consist of ten-fifteen years, nevertheless the maximum or simple term having an enthusiastic Camper loan is also become influenced by the type of Camper you may be investment, this new Rv design season, while the mileage.

The loan providers keeps some other conditions regarding financial support campers or motorhomes. Minimal credit rating needed to receive an enthusiastic Rv loan was always 600. Some loan providers may aid you should your score is in the higher 500s however, anticipate paying a higher focus rates. On the other hand, should your credit rating is within the 700s otherwise 800s, you will find alot more mortgage facts nowadays plus Rv financing cost might be a great deal more aggressive. Consumers having straight down fico scores should expect a higher Rv mortgage interest or even the request for a larger advance payment away from the financial institution.

Here are a few a camper loan calculator, observe how much cash Rv you can afford. Affordability will be based on the things like your income, credit score, debt-to-earnings ratio, cost of Rv, financing label, and you may interest. If you see the fresh estimated Rv loan payment per month, understand that it will not tend to be insurance rates, parking or shops charge, maintenance, solutions, strength, otherwise license. Very, make sure discover space in your funds to allow for these types of extra expenditures.

The lending company needs a look a for the overall economic character including your debt-to-money ratio to ensure that you can afford to choose the Camper and keep maintaining with the newest monthly obligations. Our Rv online calculator is a fantastic starting place when you happen to be Rv searching.

You should buy a keen Camper which have less than perfect credit, however you will most likely not qualify for Rv finance when you yourself have poor credit. Whether your credit score are below 680, you might have to pay dollars into Camper, workout a manager money arrangement to your seller, or set-out an enormous down payment. Additional options include taking out fully a personal bank loan, providing financing from your own credit partnership, or playing with Camper specialist investment. Certain Camper finance could possibly get make it a professional cosigner but the cosigner would have to meet up with the lender’s requirements and you may invest in getting responsible for the borrowed funds.